Peerless Info About How To Become Cpa California

If you’re looking for details on california’s cpa exam educational and legislative requirements, this guide is for.

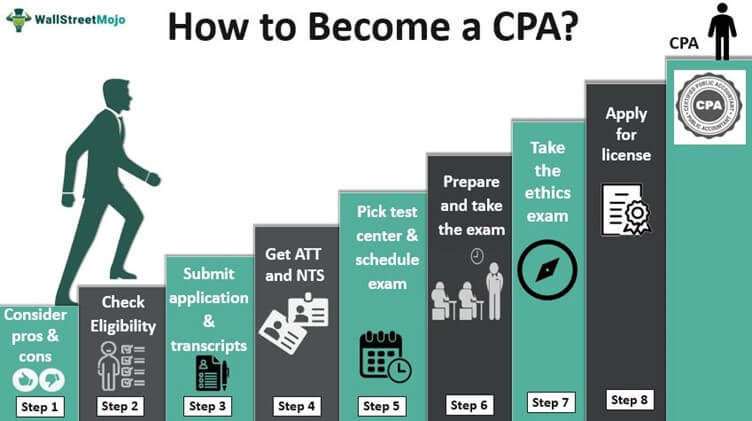

How to become cpa california. How to apply for a cpa license applying for a california cpa license. You’ll need to create an account on the california board of accountancy (cba) website at www.cba.ca.gov/cbt_public. First and foremost, make sure your school is accredited as accepted by the state of california before you take the courses you’ll need to become a licensed cpa.

Since the california board of accountancy fully integrated the protocols of the uniform accountancy act (uaa), it now requires all applicants for cpa licensure to have 150. To become a cpa in california, you needn’t be either a resident of the state or a united states citizen. However, to receive your license you must have either a.

Then you’ll complete the cpa exam application, and then print,. The above video gives you an overview of the application process, and specific. Currently, california does not recognize reciprocity.

Seventy eight of those units must be in. Pursue a bachelor's degree in accounting. As part of these 150 hours, you.

You will have the opportunity to save the. For a quick overview, check out this tip sheet put out by the california board of accountancy. To become a cpa in california, you needn’t be either a resident of the state or a united states citizen.

Applicants must provide the cba with satisfactory evidence of having completed a minimum of 12 months of general accounting experience. The online application for cpa licensure provides a means to quickly submit your application. To become eligible for a cpa exam in california, you must meet specific criteria.

![California Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/California-CPA-Requirements.jpg)

![California Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/California-CPA-License-Requirements.jpg)

![Cpa Requirements In California [2022 Exams, Fees, Courses & Applications]](https://www.ais-cpa.com/wp-content/uploads/2017/09/become-a-cpa-in-california.jpg)

![California Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/California-CPA-License-Education-Requirement.jpg)

![California Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/California-CPA-Exam.jpg)

/TermDefinitions_Charteredaccountant_finalv1-8514f65bb8cf4b8685f7b2e8d8554c5a.png)

![How To Become A Cpa In California [Updated 2022 ]](https://crushthecpaexam.com/wp-content/uploads/2019/06/UStates-Images-21.png)